[Briefing] Japan Behind the LNG Expansion in the Gulf

See PDF version here.

JAPAN is …

The Largest Importer of LNG in the World

Japan is the world’s largest importer of Liquified Natural Gas (LNG) in 2022 with 98.3 billion cubic metre of LNG import, which accounts for over 18% of the entire global LNG trade. US LNG export accounts for around 6% of LNG supply to Japan.

The Biggest Financier of LNG in the World

Japan is one of the biggest financiers of fossil fuels between 2020 and 2022, second only to Canada, providing international public finance of USD 6.9 billion. Japan was also the world’s largest provider of international public finance for LNG export capacity. Japan financed USD 39.7 billion in LNG export capacity built from 2012-2022, as well as projects under construction or expected to be built by 2026. Furthermore, Japanese private banks such as MUFG, Mizuho, and SMBC are the 6th, 8th, and 16th biggest financiers of fossil fuels from 2016-2022, respectively.

Spreading Toxic Narrative on LNG

In Japan, fossil gas is promoted both by government and industry as a “transition fuel” or “bridge fuel” that is necessary in the transition from coal to renewable energy. They also claim that gas is “clean,” “cheap,” and necessary for Japanese energy security. In this toxic public discourse, few people in Japan know what is going on in the frontline community here in the Gulf region. Further, Japan is spreading this toxic narrative on LNG across Asia, pushing governments to increase reliance on LNG and other fossil fuels in their national decarbonization and energy plans.

Pushing LNG-related Technology

This Japanese push for gas is driven by one hidden motivation: Japanese corporate profits. For big Japanese companies, their priority is to maintain and keep getting revenues from existing fossil fuel infrastructure. To this end, they introduced new fossil-fuel derived technologies such as hydrogen/ammonia co-firing, e-methane and CCS (carbon capture and storage) as a way for “decarbonization.”

They wielded their strong influence on the Japanese government to pursue and subsidize these technologies. The result is Japan’s USD 1 trillion GX (so-called Green Transformation) policy, which aims to create a massive supply chain and network of hydrogen, ammonia and CCS. This led to numerous new projects of these technologies proposed by Japanese companies, including the Hackberry Carbon Sequestration project and e-methane project adjacent to Cameron LNG.

Japan is working to create more LNG demand in Asia to grow and maintain its influence in international markets and to export Japanese technologies. Japan is pushing to both increase LNG exports from countries like the US, Australia and Qatar while also pushing for countries in Asia like the Philippines, Indonesia and Bangladesh to import LNG, build new gas power plants and adopt hydrogen, ammonia and CCS technologies.

Banking on Destruction of Community

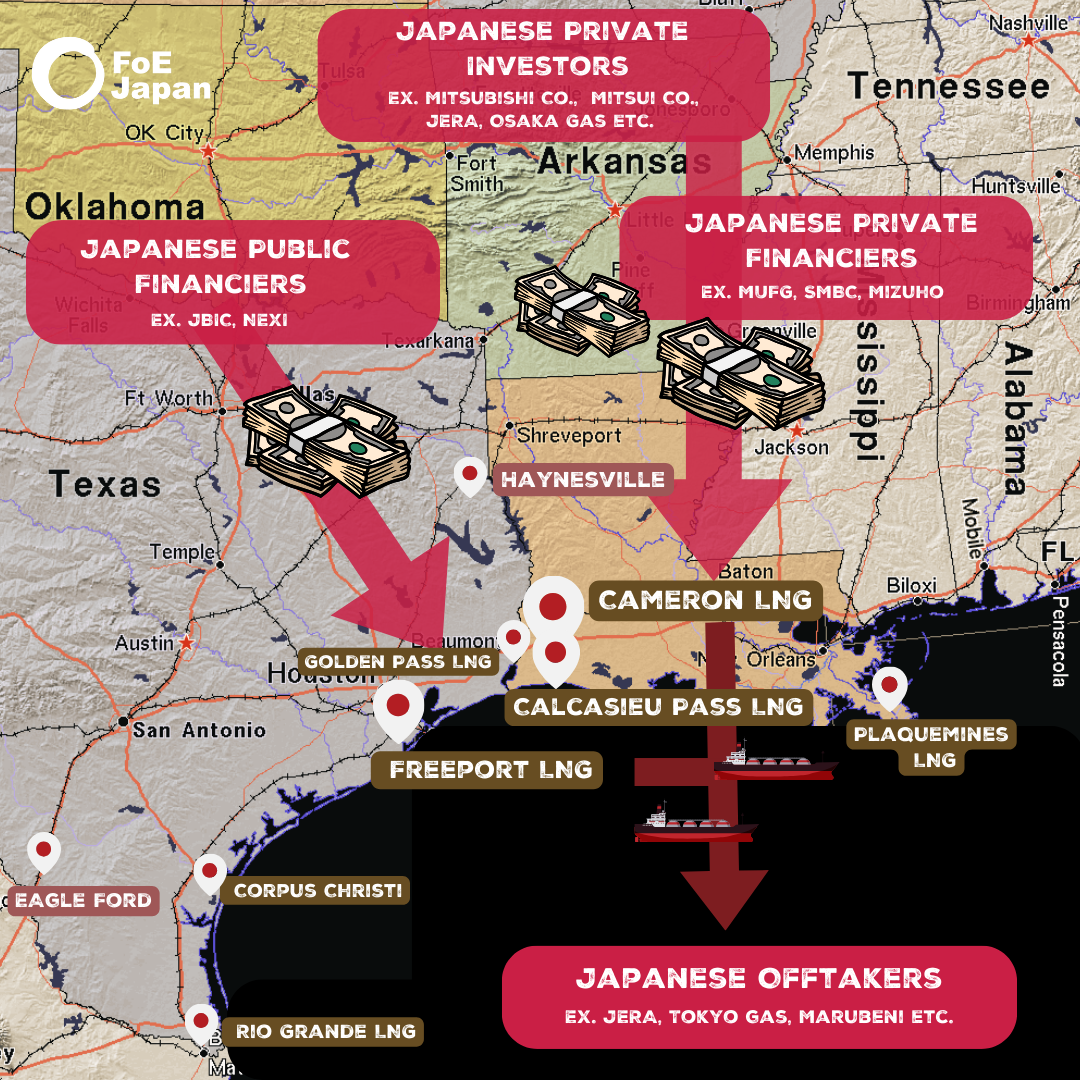

Japanese investors, financiers and insurers are banking on fossil gas projects in the Gulf region that destroy the local environment and communities. The figure below shows notable projects involving Japanese financiers. Japanese government financiers, such as JBIC and NEXI, provide loans, equity and guarantees which lower risk and provide assurance for private Japanese banks (ex. MUFG) and trading houses (Mitsubishi Co.) to finance and develop these projects.

Freeport LNG terminal: $2.6 billion loan from the Japan Bank for International Cooperation (JBIC) and $1.15 billion in guarantees from Nippon Export and Investment Insurance (NEXI).

Cameron LNG terminal: $2.5 billion loan from JBIC and $2 billion guarantee from NEXI. Mitsubishi and Mitsui have equity stakes in the project. NEXI is now considering financing and support for the expansion of the Cameron LNG terminal.

Calcasieu Pass 2 terminal: JERA, Japan’s largest gas company and the world’s largest LNG buyer, signed a 20 year contract to buy 1 million tonnes per year of LNG from Venture Global. INPEX, Japan’s largest oil and gas producer also signed a 20-year contract to buy 1 million tonnes per year.